Payment in the construction industry has come under closer scrutiny since Carillion’s collapse, and rightly so. It is unacceptable when suppliers are not paid fairly and on time. But it’s also not a straightforward problem to solve.

Challenges in the construction sector were laid out in the 2016 Farmer Review which states that the need for construction companies to maximise cash flow often leads to poor payment practices, including the use of lengthy payment terms or delaying the payment of invoices. This in turn has a knock-on effect on smaller construction companies further down the supply chain.

Improving the financial position of construction SMEs through fairer payment reduces the risk of insolvency. As well as saving businesses and jobs, it can improve the capacity of the market to deliver good value. Collaborative relationships across the supply chain are essential to increase value for money across programmes of work.

Cabinet Office proposals

This government is committed to improving payment practice in the UK, and we in the IPA want to ensure government is the best possible construction client it can be.

The government has already taken a number of important steps. In April, Cabinet Office Minister for Implementation, Oliver Dowden announced a set of measures to support small businesses, including a consultation on how suppliers’ payment performance may be used in future procurement. It considers proposals to exclude suppliers from major government procurements if they cannot demonstrate fair and effective payment practices with their subcontractors.

And just yesterday the Chancellor of the Duchy of Lancaster, David Lidington, set out new measures to enable more small businesses to compete for government contracts and increase transparency.

But the industry also needs a cultural change in payment practices if we are to succeed. The IPA recently ran workshops with government clients and representatives from the construction sector to look specifically at the different challenges and solutions to this issue. One of the many topics discussed was the use of Project Bank Accounts (PBAs).

Project Bank Accounts (PBAs)

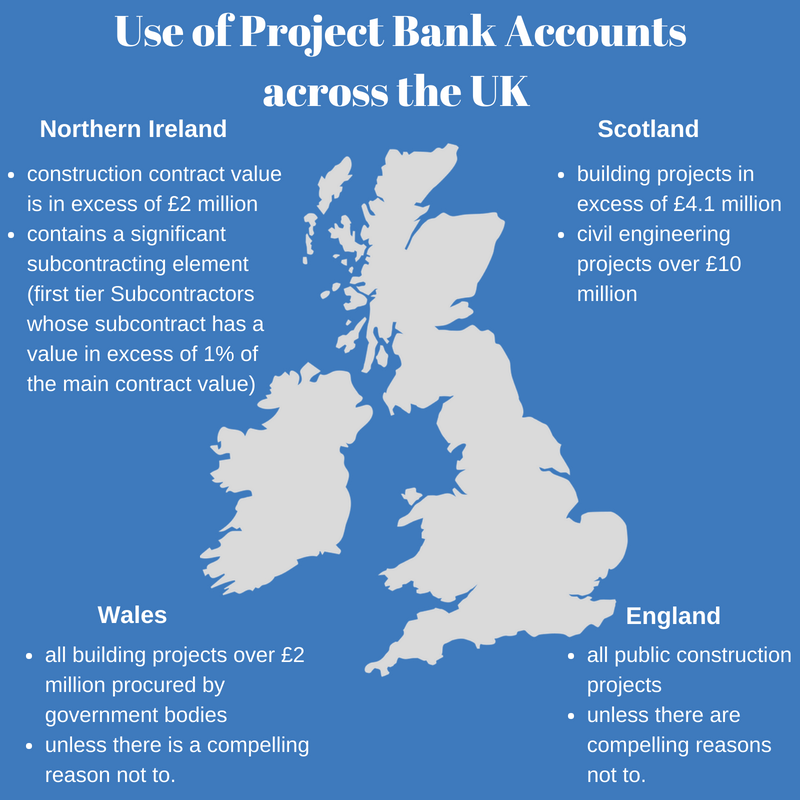

A PBA is a bank account with trust status, used to make payments due to suppliers, while providing protection to beneficiaries in the case of insolvency. They are recognised as an effective mechanism for facilitating fair payment to the construction supply chain.

The government is already committed to using PBAs on construction projects, unless there are compelling reasons not to do so. This has led to their widespread use on Highways England and Environment Agency. And very recently, Network Rail committed to pilot PBAs on certain projects.

In 2011 we set a target of awarding £4 billion of contracts that use PBAs, by the end of FY 2013/14. We exceeded this target, having awarded £5.2 billion. And since 2011, over £10 billion of contracts have been awarded that use PBAs.

As part of our latest Government Construction Strategy 2016-2020, the IPA established a Fair Payment Working Group to help departments realise the full benefits of PBAs, to unblock any barriers to uptake and monitor usage.

The main benefits of PBAs are the speed and transparency of payments, and the security of payment to beneficiaries in the case of an upstream failure. But there are also limitations. If the subcontractor contracting elements of a project is small, or the supply chain is short, it is not always cost effective or efficient to use them.

There are also administrative challenges and costs with setting up a PBA and signing up large numbers of suppliers. Often due to this complexity, only tiers 1 and 2 are able to be covered. So they don’t always protect smaller companies in the supply chain.

Payments can still only be made for invoices which are not in dispute, and upon the collapse of an upstream supplier, only monies in the account are protected. So there may unfortunately still be an element of loss of future work.

Going forward

Overall, the solution is not clear cut. Our approach has so far been to commit to use PBAs on projects unless there are compelling reasons not to do so. We want to use PBAs on all government construction projects where they offer value.

Attendees at our recent workshops agreed that current policies around PBAs are the right ones, but improvements could be achieved with stronger enforcement and improved monitoring.

We plan to include these points in our upcoming refresh of the Government Construction Strategy, to ensure that we drive forward improvements to payment practices for the whole of the construction supply chain going forward.

You can find out more about the government’s ambitions on fairer payment in the Government Construction Strategy 2016-2020.

1 comment

Comment by Alex Murray posted on

Great to see focus on this important aspect of the construction contractor business model. Understanding late payment is key to appreciating how contractors can operate on such low margins, as was raised in 2013 in the following report published alongside the construction strategy: http://www.gov.uk/government/publications/trade-credit-in-the-uk-construction-industry